Partners are the worst. They always want things. Like money. They want a say in the business and the decisions that are made. They put their foot down for the most ridiculous things. They make you spend oodles of time explaining and negotiating when you could be making money. Don’t get a partner.

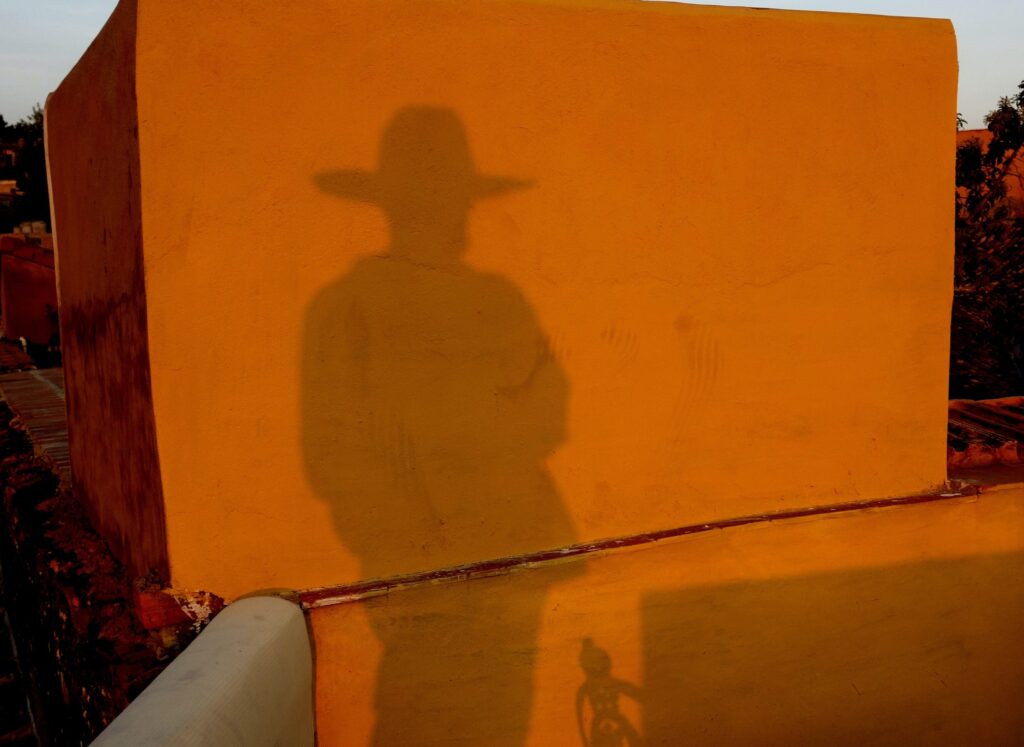

Except if you need one. Then you should get a partner. I say those statements tongue-in-cheek. Some partners are the best. But you rarely get to know this before signing the operating agreement. Get the wrong one, pardner, and you are in for a headache that could last years.

Despite all the reasons to not have a partner, they do provide some benefits: They can bring work, expertise, or money. If you have all of these, then don’t get a partner. If you are missing one or more, then you might benefit from teaming up. Only work with a partner who brings something you don’t have to the table. If you both are really knowledgeable in multifamily and can do work but don’t have money, it doesn’t make sense to partner up, but if you can do work and have the knowledge and your partner has the money, this might just work out for you.

It All Comes Down to Tie-Breaking

The whole point of thinking about this is to avoid dead-lock. This happens if 50% of the votes want one thing and 50% want another. The business is stuck, and that can kill the operation quickly. All that time and money invested goes up in smoke. If you have an odd number of partners, it’s a little better, because a tie can be broken. If you are planning to team up with one partner, I always recommend that one person has > 50% of the decision-making capacity. That solves it. But what if you insist on being 50/50? That’s where the shootout clause comes in.

The Texas Shootout Clause

Also known as a shotgun clause, the Texas Shootout Clause is put in an operating agreement as the last option when the partnership is dead-locked. It has the effect of terminating the business, leaving one partner as the sole owner. It should only be exercised when all other avenues have been exhausted.

When one partner exercises the clause, they must give the other partner written notice of their intent to purchase all of the other person’s ownership in the company. Partner 1 will offer to sell all their shares at a certain price per share. Partner 2 will then have a certain number of days (specified in the clause) to either buy them or to sell all their shares to Partner 1 for the same price per share. This encourages Partner 1 to offer a fair price, or otherwise get bought out for cheap – or have to pay top dollar.

Downsides to this clause are that there must be a strategy put in the operating agreement outlining how payment will be made for the shares. This will typically be a lot of money and most people don’t have the cash sitting around for it. Typically there will be a monthly or annual payment required with escalating penalties for late or missed payments.

Take a long hard look first at whether you should be 50/50 partners before doing this. If you plan to go forward, take another long hard look at the shootout clause and make sure it details every possible outcome. Make your agreements up front even though you are best of friends now. It’ll save you tremendous pain in the future.