Oh, man, the wait was so long. You asked about how to get from where you are now to being ready for retirement by the use of real estate. There are 7 steps in this process and I give them to you now:

The 7 Steps for High Income Earners to Safely Retire

Step 1: Decide

Step 2: Commit

Step 3: Strategize

Step 4: Act

Step 5: Build

Step 6: Teach

Step 7: Retire?

Simple, right? We’ll deep dive into the last 6 steps in later articles. For now, let’s discuss Step 1.

Step 1: Decide

In order to begin, you need to come to the Decision that planning for your future through real estate is the right thing for you. I’ve a friend who has made big money putting his extra money in the stock market through a financial advisor. I think that is great. She realized she had extra money and rather than buying things she found a way to invest. She will tell you that she has made 10% yearly over the past 5 years of her investment. I think that is also great.

I would like to get her involved in my real estate investments. I know she could do better. But she is very happy with her prior returns, it would be hard to convince her otherwise. She makes a lot of money and she is willing to give up control in order to not have work. She doesn’t want to make the decisions on where to put that money. She is willing to pay her advisor to pay a manager to do that task. The sad truth is that these managers on average fail to beat the market.

So, what is my friend really paying for? She gets the privilege of paying someone to invest her money. She feels like she doesn’t have to think about her money. Except, when the market is down. Then there are frantic calls to her manager. But normally, she just hands over her money and pays someone to control it. In real estate, we would freaking love to find someone like that. I’d jump up and down it if someone came up to me and gave me $100,000 to invest in my project and also offered me 2% of any returns she made. My friend is paying for convenience. She could do better going out and choosing Exchange Traded Funds herself, but that is work. She is the Ron Popeil Infomercial watcher of investors, set it and forget it. Real estate is the long game. It takes work. But you are a Hard-Worker™. Why not do it?

But, I’m Diversified

OK, you still don’t believe me. Your financial advisor through your employer, whom you never have met, has said that it is good to diversify. If the industrial sector crashes, at least you will have other sectors. The problem is that it usually doesn’t happen that way. There are generally some winners, like bonds, and many losers. Do you know what percentage you have in bonds right now? I’ll bet less than 10%. Your diversification strategy just diversified you into many losers.

But, I Have Real Estate Stocks

If the stock market crashes, real estate will crash too, so it doesn’t really matter what you invested in. A crash is a crash, and after all, real estate gets much of the blame for the Great Recession in 2007 – 2009.

If the stock market crashes, it’s true that real estate would crash as well. You probably have some stock in real estate right now. The fact that some of your money is in real estate stocks won’t protect you from a crash, even if real estate is as good as I say. I don’t claim real estate won’t take a downturn, in fact, I welcome it. Let that sink in.

If Real Estate is So Good, I’ll Just Tell My Financial Advisor to Move Everything to Real Estate Stocks

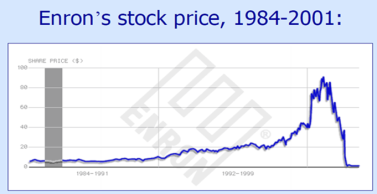

Oh man, that is the worst thing you can do. No financial advisor worth his salt would let you do that without a fight. All your eggs in one basket and that sort of thing. What you are missing is the very important and powerful element of control. When you purchase a share of stock, you give up the control of your money. Perhaps you bought stock in Enron NYSE: ENE.

If you did so in 1984 you would have a pretty penny in your portfolio at the end of the millennium. But Kenneth Lay and his cronies got up to some shenanigans and ruined it for everyone. If you held onto the stock in 2001, you would have lost nearly everything.

This happened because of a few people, over whom you had absolutely positively no control. These guys have padded their bank accounts in the past and they will do it again. The CEO of the Real Estate Investment Trust you bought into might do a similar thing. When you by stock you have to do little work but you give up control. If you buy an investment property you buy it on your terms and if you learn how to do it correctly, a stock market or real estate crash will not sink you. In fact, you will see that crash as an opportunity.

Make the Decision to Invest in Real Estate. Once You Do That, You Can Move on to Step 2: Commit

As a bonus, I’m going to give you your first book assignment. The Richest Man in Babylon by George S. Clason*. This is my #1 favorite Mindset book. It is told in short stories and each helps to drive the point home: take a percentage of everything you make (10% is recommended) and invest it. It is so very simple but turns out to be amazingly difficult. The key is to take your 10% out before you do anything else. You may have to cut your expenses to do it, but once it is done, that tiny wealth will grow and grow. You won’t even remember on what you had been wasting that money. The book is short, easy to read, and entertaining. Someone as intelligent as you could read it in a day. It took me two 🙁

*the book link will take you to Amazon. If you purchase the book, Amazon will give me a small commission. I’d appreciate if you got the book through this link; it keeps me writing.